Depsite a strong rally...people wanted out at the close...even the shorts were not buying. Additionally the spread between leveraged and leveraged inverse ETFs are at nose bleed levels...this usually reverts back to parity with market weakness.

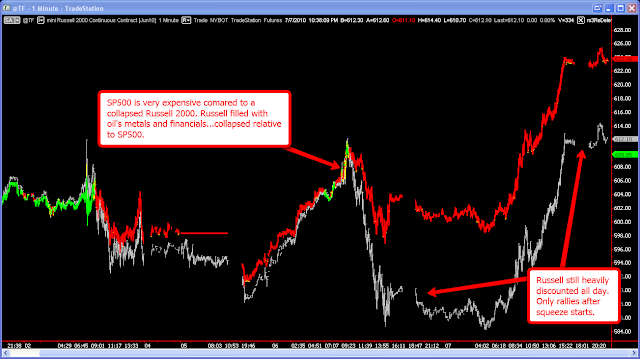

Lastly, the Russell is usually a leader and can give an edge. Theoretically this index should be at 645 to 660ish by now. It got crushed relative to the SP500 which is now very expensive vs the Russell.

Additionally, Goldman Tax said today "Bottom is in". Given the fact that you would have lost 300% of your collateral requirements or more based on their EURO calls over the last 3 months...I would say they bought when they recommended to short...and sold when they recommended to go long. I wonder what their case is with the equity markets? Reason enough to be very careful is the idea that Goldman and friends are selling into it while telling everyone else to buy.

The ideal setup for the market would be to see mild selling if it were to occur tomorrow...followed by a reasonable close. This could allow us to move up to the 1070 to 1090 area which would likely be shorted by nearly all of the swing systems. Keep in mind that given the weakness under the covers of the rally today, upside follow through from here is optional not necessarily most probable.